swap in forex means

Swap free trading accounts do not generate swap interest which makes them ideal for Muslim traders. Swap in forex is an agreement about the exchange of currencies at the start and reversal exchange at the end of the contract.

Trader at Foreign Exchange Market 2018-present Answered 8 months ago Author has 78 answers and 268K answer views.

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

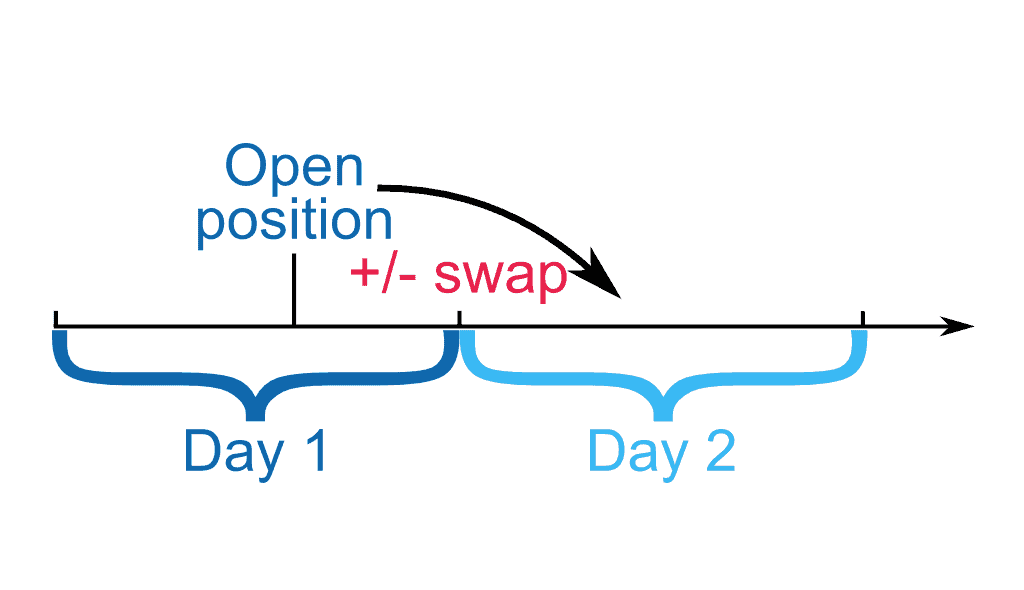

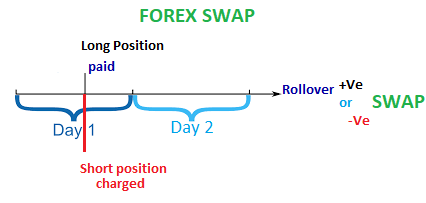

. This means that we have almost every variable to receive a final number of the swap rate. So a swap in forex trading is the interest that you pay or receive for keeping an open trade overnight. The Foreign exchange swap or Forex rollover is a type of interest charged on overnight positions οn the Fοrex market.

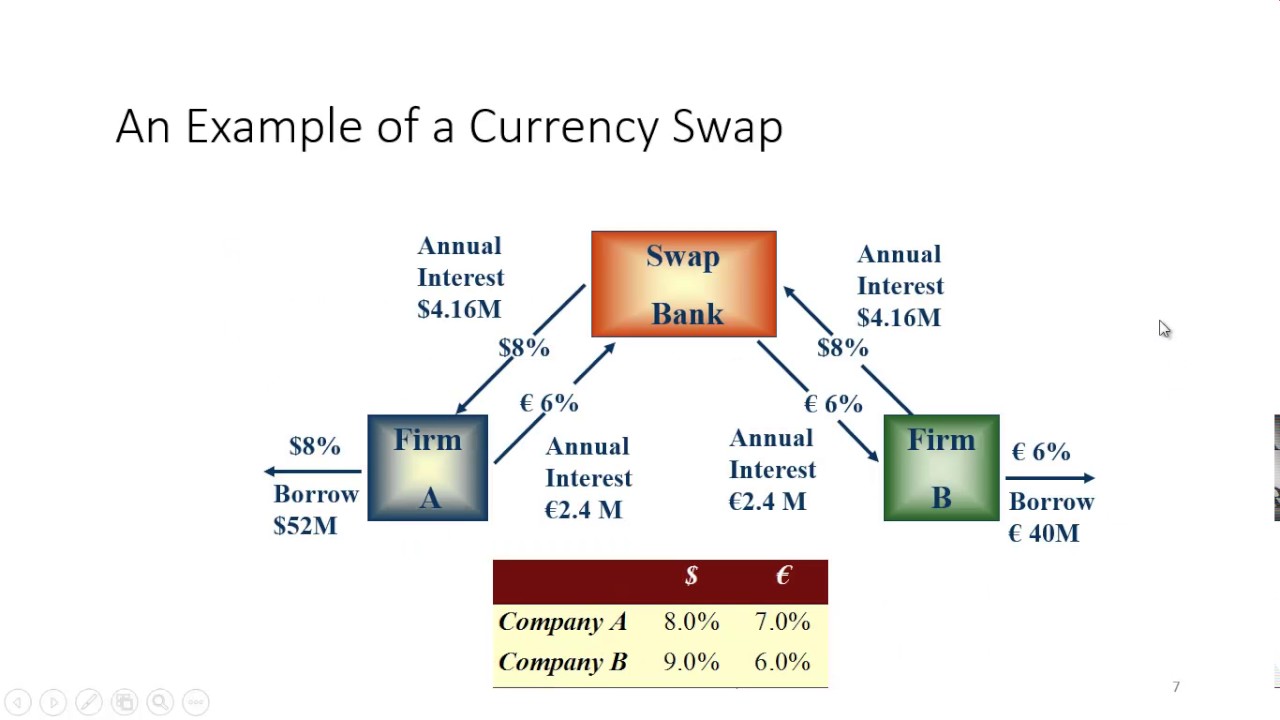

What is a swap in Forex. Lets suppose the EURUSD asking price is 11824 the interest rate of EUR is 416 and the interest rate of USD is 36. They are after all.

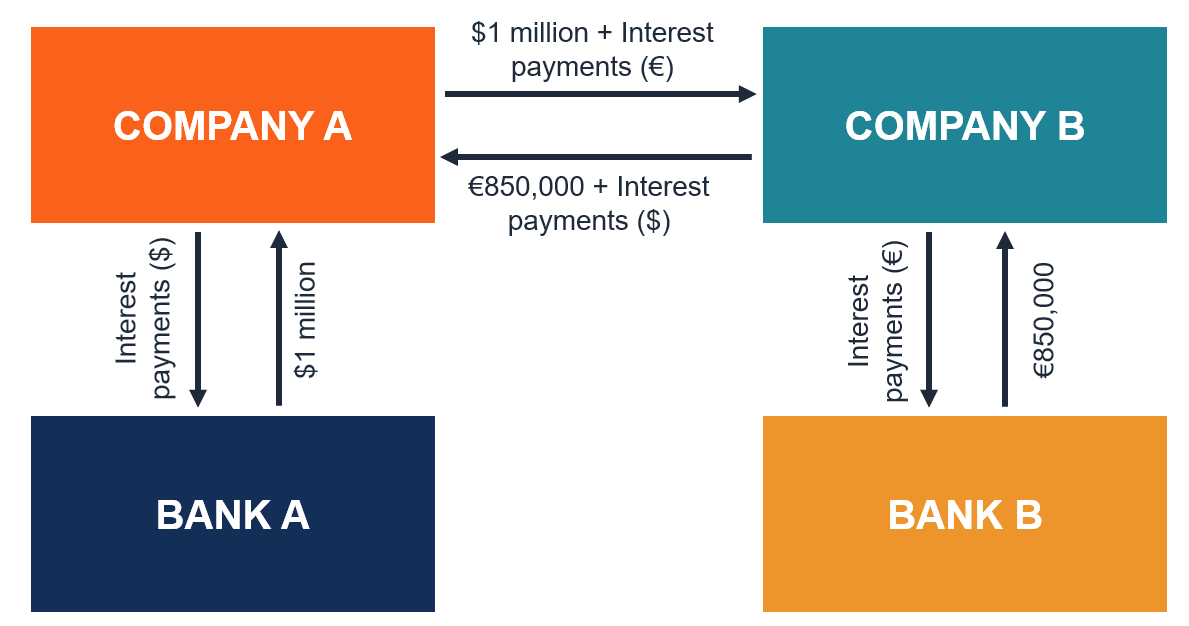

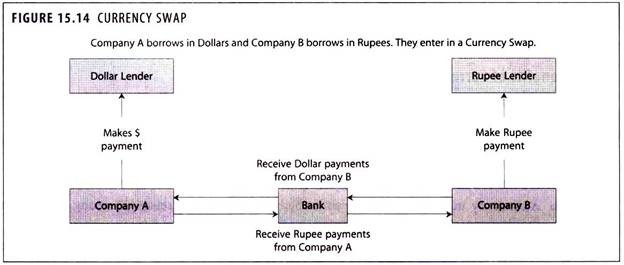

It is useful for risk-free lending as the swapped amounts are used as collateral for repayment. A currency swap is a foreign exchange transaction that involves trading principal and interest in one currency for the same in another currency. In simple words swap is a special operation that carries an open position in a trading instrument overnight for which the difference in interest rates is credited or charged.

A foreign currency swap is an agreement between two foreign parties to swap interest payments on a loan made in one currency for interest payments on a loan made in another currency. Swap is the forex market that is charged by the broker for keeping a position open overnight in the market by the trader. What is the meaning of swap in forex trading.

Swap is also referred to as an overnight interest or a rollover rate. Each currency has its own interest rate and each forex transaction involves two currencies and therefore two different interest rates. Swap in forex trading is simply the interest rate that is either paid or charged to you at the end of each trading day.

A similar swap is alsο charged οn Cοntracts Fοr Difference CFDs. The swap agreement always says what is exchanged when the exchanges happen and what are the prices of the exchange. Calculation of Forex Swap.

The charge is applied tο the. However there is no need for the real delivery of the currency in case of speculative trading speculative trading is something that you are about to start. According to the swap calculator Swap equals position interest difference commission 100 price days per year.

The interest rate paid or received by a trader is referred to as a swap in forex trading. A swap is an in-trading Forex fee that youre either charged or credited depending on a certain set of conditions. It means that all the deals are made with the actual delivery of the currency the next workday after their execution.

What is swap in the Forex market you can understand from the name itself. It is charged to open trades aimed at buyingselling the foreign currency which is essentially an exchange of currencies. In forex a swap is a commission or rollover interest that a broker charges when a trader decides to keep their position open overnight.

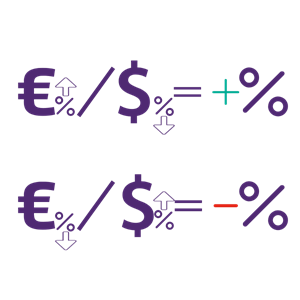

The first swap is a long swap. There are two types of swaps. If the exchange swap is higher for the currency that is bought than for the currency sold a trader will receive a further swap.

Transactions on the Forex market are made on Spot terms. Swap in Forex is an interest fee thats charged or earned for keeping positions open overnight. When you trade on margin using leverage and hold a position overnight you receive interest on your positions that involves buying currencies of a country that has a higher interest rate and contrary to that you pay interest on positions selling such.

So you will either be paid out at the end of the day or you will have to pay in. It depends on the interest rates of each currency in the Forex pair whether a trader receives or has to pay a swap. A currency pair such as EURUSD means you need to buy euros and sell dollars at the same time in a long position or sell euros and buy dollars at the same time in a short position.

This also explains why swap free accounts are also called Islamic forex accounts. This institution controls its design supply and interest rate. Explanation of The Forex Swap.

Currency interest rates Every currency is managed by a central bank of the originating country. Forex swap is not actually a physical swap. A foreign exchange swap also known as an FX swap is an agreement to simultaneously borrow one currency and lend another at an initial date then exchanging the amounts at maturity.

Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to your account when the days trading comes to an end. A foreign exchange swap often known as a forex swap or FX swap is a financial transaction that involves the simultaneous purchase and selling of equal quantities of one currency for another with two separate value dates normally spot to forward. These swaps come in two forms.

Long swaps these are used when you have an open position that you have bought gone long and kept overnight.

Swap In Forex How Does It Work And How To Avoid It

Currency Swap Quantra By Quantinsti

The Ultimate Guide To Forex Swaps Forex Academy

Forex Trading Academy Best Educational Provider Axiory Global

Currency Swap Contract Definition How It Works Types

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

Foreign Exchange Swaps Fx Swaps Vs Currency Swaps

Swap Definition Forexpedia By Babypips Com

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

Currency Swap Vs Interest Rate Swap

What Is Swap In Forex A Beginner S Guide Tradefx

What Are Swaps In Forex Forex Academy

Secrets Behind Forex Swap Complete Guide Freeforexcoach Com

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)